The latest GOLD reserves were published yesterday.

And China is back stockpiling!

If you follow our updates regularly you know, we are bullish GOLD.

Long term view!

And various elements are now aligning to deliver a nice rally over the next two months.

Here’s what we need to know:

First of all.

As mentioned above.

Central banks demand is HIGH.

Central banks (mostly BRICS) are out there stockpiling GOLD.

And they will continue to do so.

Why?

Tariff risks.

Sanctions risks.

I mean…

Trump risks?!

Think about it…

Geopolitics from January 20 will be driven by ego, emotional decisions, mocking, flexing, and other Trumpisms.

I mean…

Have you heard yesterday’s speech?

Trump’s answer?

Come on!

Of course he’s just mocking journalists there (hopefully).

But still, that’s the type of comments and risks that will drive geopolitics from January 20.

So you know…

Central banks and countries (the most Trump exposed ones) are piling up on GOLD.

The safe haven of safe havens when your country is threatened left and right.

So there you go!

Ok.

On top of that…

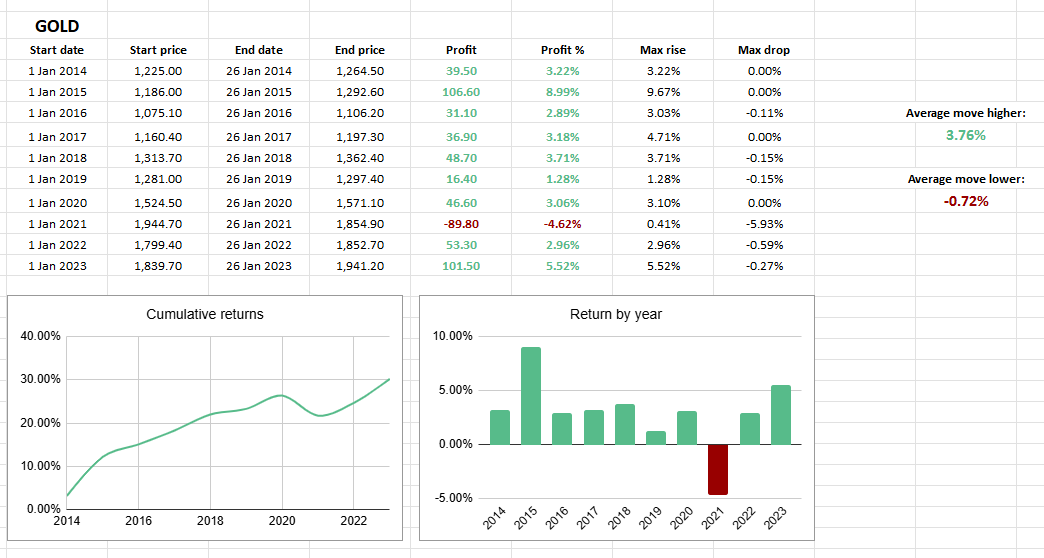

Seasonality is bullish:

January is famously bullish for GOLD.

February is too.

So there are two months ahead of bullish seasonality.

Make of it what you want!

We are bullish and long with the Private Network.

Long term view.

Long term trade.

Just keep in mind the short term risks with the NFP on Friday.

A strong number there would delay the bullish flows a bit.

A soft one instead…

Would add up to the bullish case.

With that said…

The way for us to know whether you enjoy this type of content is to hit those cool buttons below 😉 so don’t hesitate, let us know.