Let’s get straight into it.

The July NFP headline came in... meh.

But that’s not the key point!

The real kicker is in the revisions.

May has been revised down to 19k

June has been revised down to 14k

Suddenly, the story isn't:

"Oh, July NFP was a bit weak."

The story is:

"Oh, wait a second...we've now had three consecutive months of NFP under 100k."

One soft month can be a blip.

Two is a concern, but maybe not.

But three? Three in a row?!

Ok! It’s pivotal:

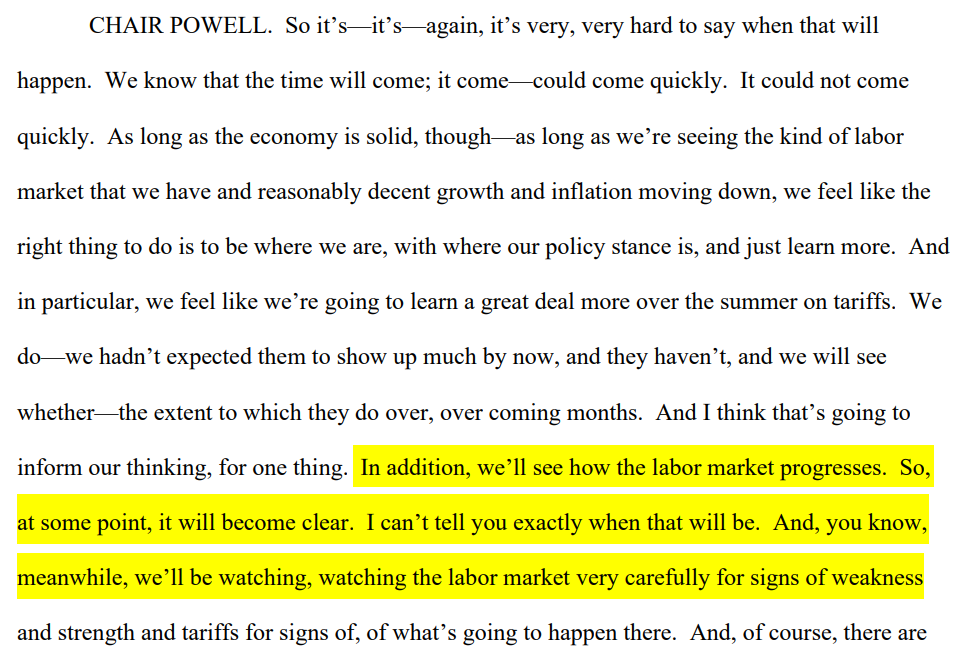

Now, let me show you a transcript of what Powell has been saying repeatedly:

Let me repeat…

“I’ll be watching, watching the labor market very carefully for signs of weakness.”

His entire argument, the pillar holding up the whole hawkish framework, hangs on two variables:

Inflation

Labor market

If one or the other falls out of place, they have to act.

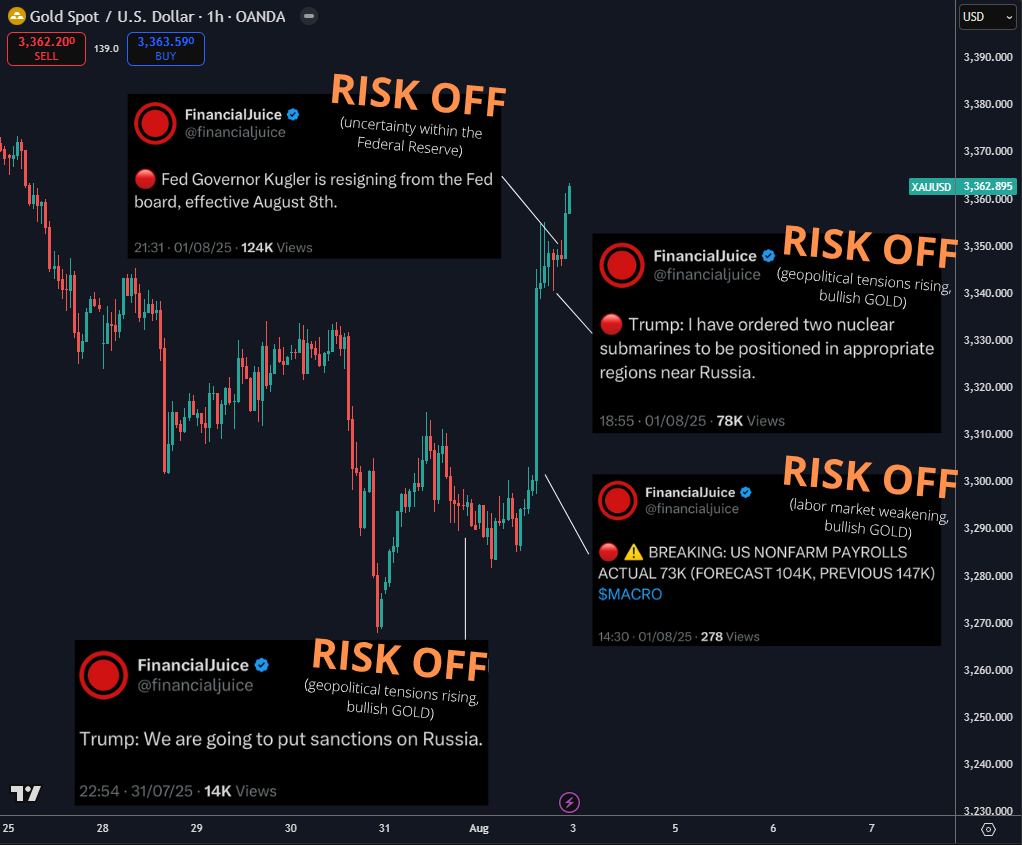

And now the entire narrative just flipped with the weakening labor market.

Moral of the story?

Watch for higher EURUSD, higher GOLD, and lower USDJPY ahead.

The moves that started on Friday…

Will continue.

In particular, on the precious metal:

With that said…

The way for us to know whether you enjoy this type of content is to hit those cool buttons below, so don’t hesitate 😉 let us know.

Will it push stocks/indices to higher side?

Dxy will bottom extremely lower, in your words?