There’s (another) major tariff deadline coming up.

You know the one.

The guy with the… let's call it “assertive” negotiating style.

Him, yes!

Well, so far, he’s landed a whopping 3 deals.

Out of, you know…

193 countries.

And so what’s he doing now?

He’s doing it all over again!

Now, most people will see this and either get mad (politics) or just ignore it.

Not us macro traders.

We see an opportunity!

A simple, two way trade on this.

Scenario one:

The deadline hits.

No major deal with Europe, Japan, and other major trade partners.

In simple…

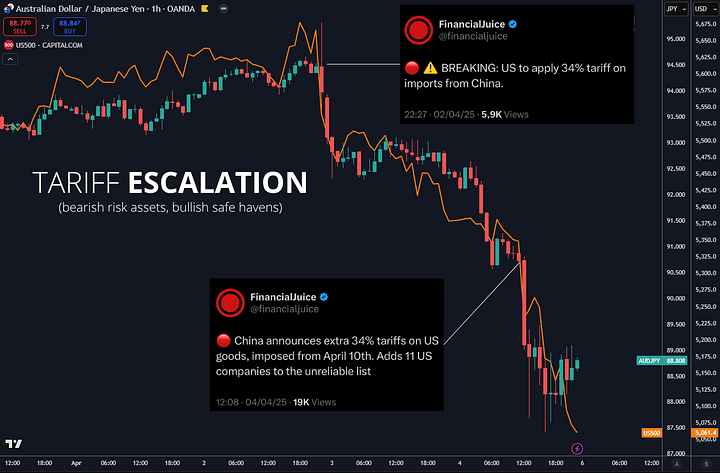

Tariffs go back near the (crazy) April 2 levels.

What happens?

Well, EXACTLY what happened on April 2:

Just look across the board at what happened on that date.

The US Dollar got caught in the “sell America” trade.

Funds ran to safety, out of risk assets (crypto and equities) and into safe havens.

Simple, right?

Tariffs up = USD down against EUR, CHF, JPY and GOLD.

The same is going to happen again, if no deals are signed.

Scenario two:

The art of the deal.

Or the art of the TACO (Trump always chickens out).

What happens if tariffs DON’T go up?

The exact opposite!

So if deals are reached, or if another deadline extension is granted.

Then:

The US Dollar gains.

Safe havens weaken.

That’s the entire playbook.

Tariff escalation vs tariff deescalation:

Simple, and straightforward.

That’s how we like it!

With that said…

The way for us to know whether you enjoy this type of content is to hit those cool buttons below, so don’t hesitate 😉 let us know.